No one can afford to make mistakes estimating a job. The difference between making the sale and not making it often depends on correctly costing and pricing your work. Equally important, you want to price your work so your business actually covers all of its expenses as well as making a reasonable profit and not leaving any money on the table.

No one can afford to make mistakes estimating a job. The difference between making the sale and not making it often depends on correctly costing and pricing your work. Equally important, you want to price your work so your business actually covers all of its expenses as well as making a reasonable profit and not leaving any money on the table.

While totaling the direct labor, direct material and other direct costs for a job is easy, how do you allocate an appropriate amount of your overhead costs to the project? How do you determine an hourly shop rate? With so many methods for estimating jobs, which one is right for your business?

The method that I advocate is one that I used as an estimator for a large screen printer. It is one of the easiest and most popular ways for a small or medium size shop to cost their jobs. This estimating procedure uses direct labor as the cost driver for allocating an appropriate amount of your shop and administrative costs to a project.

Before describing this estimating system, I need to explain some basic cost accounting terms, beginning with direct costs, which are comprised of three components:

- Direct Labor

- Direct Material

- Other Direct

Direct Labor Costs

Direct Labor. In discussions of labor costs, you probably have heard many different terms used. Sometimes these terms are used incorrectly. To avoid any confusion, let’s start with a few basic financial definitions.

Direct labor refers to the actual wages paid that you pay workers in your shop to complete a particular activity in the production of a job. It typically only applies to line workers and does not include any wages or salaries paid to supervisors or office personnel.

Direct labor hours are not considered part of your shop overhead. Direct labor usually does not include any benefits, such as health insurance, dental insurance and payroll taxes, nor does it factor in vacations, holidays or sick time. Instead, these benefits should be categorized as part of the overhead (shop and administrative costs).

Direct labor only applies to costs, which are directly traceable to a specific job. This can include the time for machine set up, production time and clean up. It would not include any time that your employee might spend during the course of a normal day answering phones, speaking to walk-in customers, performing housekeeping activities or routine maintenance on shop equipment.

As an example of estimating direct labor costs for a job, you may determine that to plotter cut, weed, premask and apply a graphic to a sign blank will take 1.25 hours at an average raw labor rate of $12 per hour for a total of $15.

1.25 hours production time x $12/hour = $15 direct labor cost

Indirect Labor. This refers to the number of labor hours devoted to tasks other than production, such as performing machine maintenance, clerical tasks or attending to customers. Whereas direct labor hours are not part of shop overhead, indirect labor is. In a small sign shop, where employees wear many different hats, as much as 40% of labor hours are indirect labor.

Burdened Labor. A fully burdened labor rate would include all of the benefits, payroll taxes, insurance and any other employment costs that you pay in addition to the employee’s wages to keep them on the job. This burdened rate is not the same as an hourly shop rate, which uses direct labor hours as a cost driver for allocating overhead expenses.

Overhead Allocated to Direct Labor. For a job shop, such as a sign shop or printer, the simplest way to allocate overhead to your jobs is to divide it evenly across the total number of direct labor hours. By doing this, you will calculate your shop rate.

If you decide to allocate overhead costs to direct labor, which I recommend, you need to estimate the number of hours that you and your employees will directly spend on a job and multiply it by the hourly shop rate.

Example:5.75 total direct labor hours X $50.00 hourly shop rate = $287.50 total labor cost

Determining your shop rate is covered in detail later in this article.

Direct Material Costs

Direct Material refers to the raw material estimated to produce a job. When I worked for fleet graphics screen printers, these materials included the cost of the vinyl film, the ink, clear coat and the premask (application tape).

In estimating the materials needed, you should always factor in a percentage for material loss or scrap. For many jobs, an additional 10% may cover your scrap rate. That percentage, however, could be higher depending on the difficulty involved in producing the job.

For example, if a screen printer is printing a halftone or 4-color process job, the scrap rate is usually much higher, perhaps as high as 25%. You may also need to include additional material that is required for progressive proofs.

Other Direct Costs

Other Direct refers to any additional costs for tooling, materials or services, which are required to produce a specific job. In screen printing, other direct costs could include the cost for dies, color separations or design services. In sign making, other direct could include any special paint or tools that you would only use on the job it was ordered for. It might also include any part of the production costs that you need to farm out to another company.

Cost of Goods Sold

In discussions of accounting and estimating, one of the terms that you will frequently encounter is “Cost Of Goods Sold” (COGS). For a job shop, such as a sign business, digital printer or screen printer, cost of goods sold simply refers to all of the direct costs that are charged to a specific job. These direct costs include:

- Direct Material

- Direct Labor

- Other Direct Expenses.

NOTE: Cost of Goods Sold (COGS) and Cost of Sales (COS) are frequently used interchangeably. However, manufacturers, such as sign shops and printers, often use the term COGS. Retailers, on the other hand, frequently use COS.

Cost of Goods Sold only includes direct costs, but does not include any indirect costs. In costing any services, such as application of vehicle graphics, COGS typically just includes direct labor cost.

Comparing the COGS to revenue ratio (in other words, the percentage of your direct costs to your sales) is relevant to a shop owner or manager in the following ways:

- It indicates how well you are buying your raw materials and controlling your labor costs

- It reveals how much money you have available in the job to cover your shop and administrative costs (in challenging times, this comparison may provide you with the justification to take on some larger, low risk projects to cover shop overhead)

- It helps in calculating your shop’s gross margin for a select period of time

For a small business, such as a sign shop, a desirable COGS to Revenue Ratio is typically 20%. For a larger shop or business in a different market an acceptable ratio could be much higher.

Applying a Burden Rate to Material Costs and Other Direct Expenses

Because direct labor is related to every aspect of indirect costs, it is an effective cost driver for allocating overhead to jobs. However, what happens when you are just buying and selling material and services and no direct labor is charged to a job? No overhead is allocated.

In addition to allocating a portion of overhead costs to direct labor costs, you should also apply a burden rate to raw material costs and Other Direct expenses. A “burden rate” is another term for allocating or applying a percentage of indirect costs or overhead to the direct costs of a job.

In the case of assigning a burden rate to direct material and other direct costs, many shops will apply 10% to these costs. For example, if the raw material cost including a percentage for scrap (vinyl film, ink, laminate and application tape) is $100.00, an additional 10% burden rate (calculated by dividing by .9) would result in a burdened material cost of $111.11

Applying a burden rate to direct material and other direct cost, will allocate a rightful amount of overhead to jobs in which you are merely buying material, such as striping, or outsourcing a service, such as vinyl application, and reselling these products or services. (NOTE: After burdening these products and services, you still need to factor in the profit margin for the job.)

Indirect Costs

Indirect costs are those expenditures, which are not directly traceable to a job, and consequently not directly charged to the manufacturing of a project. Nevertheless, a fair amount of those indirect costs must be apportioned to the job.

Some examples of indirect costs are shop overhead, advertising expense, supervisor salaries and taxes. Indirect costs can also include direct material expenditures for supplies, which are impractical to trace to a specific projects, such as screws, glue or lettering enamel. In these cases, it makes more sense to treat charges for these materials as part of shop overhead.

Calculating direct costs that apply to a specific project is the easy part of estimating. These calculations are fairly cut and dry. What can complicate costing is how you allocate indirect expenses or overhead to the cost of a product. Estimators have devised many different methods for doing this. Some methods are better than others.

If you were making just one product, such as printing one type of T-shirt, allocation of overhead would be very easy because you could merely divide all of your shop and administrative expenses by the number of products produced within a specified period. The amount of overhead allocated to each product would be the same.

Estimating for a job shop, such as a sign business or a digital printer, is not so cut and dry, because direct costs vary from one job to the next. Production of sign A might have $1000 in direct costs, whereas sign B might have $50 in direct costs. If both projects share the same amount of overhead, does this make sense?

Suppose that that equally shared amount of overhead is $50. That would make the cost of sign A $1050 and the cost of sign B $100, even before we factor in our profit margin. In this example, allocating the same amount of overhead to each project would ultimately result in one product being underpriced while the other would be overpriced.

Graphics projects are typically comprised of several different parts. For example, a vehicle graphics design usually includes several different design elements, including a logo, company name, a slogan, striping and a phone number. You must estimate the cost for each of these individual parts.

SUGGESTION: When you present pricing to your prospects, do not provide an itemized cost for the parts. This only encourages your prospect to shop the prices of the parts. Only present a total price for the project.

The cost of each part is comprised of direct costs and indirect costs. Direct costs consist of direct labor, direct materials and other direct. Direct costs are expenses that are directly traceable to the job. In the case of direct material, these expenses could include the cost of vinyl, substrate such as aluminum composite material and extrusions. Supplies, which are difficult or impossible to estimate in the production of job, such as screws or glue, are typically classified as another indirect cost. In the case of digital printing, it could include the cost of ink.

Indirect costs include all of your expenses other than direct costs. These indirect costs, which comprise your overhead, fall into one of two categories: fixed and variable shop and administrative expenses.

Fixed & Variable Expenses

In estimating a job, a portion of your shop and administrative costs (or overhead), must be absorbed into the cost of the job. For a small or medium-sized shop, overhead refers to all of your shop and administrative expenses, which are not directly charged to jobs. These indirect costs are often categorized as either fixed expenses or variable expenses.

Fixed Expenses. As the name implies, fixed expenses stay the same from one month to the next or, at the most, change very little. Because these costs are relatively constant, they are predictable, which you might consider as a positive. The downside to a fixed cost is there is not much you can do to manage these expenses. Obviously, this can be a problem during an economic downturn. Examples of fixed expenses include:

- Building rental or mortgage payment

- Car lease or car payment

- Building Insurance

- Equipment depreciation

- Management salaries

Variable Expenses. On the other hand, variable expenses can vary or fluctuate from month to month. Because variable expenses can change, which often happens among companies that are growing rapidly, they affect your shop rate. For this reason, you should track your shop overhead as well as your direct labor hours and adjust your shop rate accordingly. Examples of variable expenses include:

- Utilities (Gas and Electric)

- Water and Refuse

- Travel

- Entertainment

- Cleaning Supplies

- Office Supplies

- Phone

- Advertising & Sales Promotion

- Postage & Shipping

- Website Development

Controlling Your Variable Expenses. In any shop, variable expenses as well as revenues fluctuate over time. When they do, the multiplier used to allocate costs can change too. There’s nothing that you can do to change fixed expenses or direct costs. On the other hand, you can take steps to keep variable expenses and some direct costs in check.

The first step is to carefully monitor expenses, in both good times and bad. Other measures include questioning the value of every purchase to your shop; taking advantage of discounts; and obtaining multiple bids for raw materials. You should also encourage employees to look for ways to cut costs. Finally, you can reduce unnecessary inventory of shop and office supplies. Every step you take to lower expenses, decreases overhead and shop rate, which makes you more competitive and increases your bottom line.

Calculating Your Shop Rate.

In visiting sign shops across the country, one of the most common questions that I have been asked are what shop rate are other shops charging for labor. One shop might charge $50 an hour. Another shop could charge $60 per hour.

Using an average rate may not be accurate for your shop, because the overhead for your shop will be much different than the overhead for a competitor’s shop. The productivity rate for two shops can also vary greatly. The better question is how you can calculate an accurate rate for your shop?

In allocating overhead to direct labor hours as your cost driver, here’s a simple way to calculate your hourly shop rate:

● Add up your shop and administrative costs (overhead) for a particular period, such as a year. You can easily find past costs from the financial documents that your accountant creates for you, such as an income statement (P&L).

● Calculate the number of direct labor hours for the same period. This should be easy, if you use labor tickets.

● Divide your overhead by the number of direct labor hours.

Example:

Shop and administrative costs during a month

Number of direct labor hours during that month = Hourly Shop Rate

$6000 (Overhead)

120 (Hours Charged Directly to Jobs) = $50/hr. Shop Rate

You can use your history of past overhead expenditures and direct labor hour to determine your shop rate. The shortcoming of using past data is that it may not be indicative of future expenses and direct labor.

To compensate for anticipated changes, you may wish to use this historical information as a reference point. Using this information as your benchmark, you can forecast future costs and direct labor for the upcoming year. Based on your projections, you can adjust your shop rate.

Activity Based Costing

A shortcoming of applying overhead to direct labor is that a disproportionately high amount of overhead may be applied to low skilled manual labor jobs. The result of using an averaged burdened shop rate for all types of jobs is that you could price yourself out the market for labor intensive projects.

On the other hand, projects which are run on very expensive equipment, but requiring much less labor, may be underpriced. You might be winning many of these contracts but may not be covering a realistic share of the overhead.

To correct for the shortcomings of applying an averaged burdened labor rate, you may want to consider allocating overhead costs based on specific job activities within your shop. This means that you will need to establish different burdened rates for each type of function or department within your shop.

In other words, you could establish different rates for different types of printers, as well as different rates for weeding and masking computer cut vinyl. Or in a screen print shop, you could base hourly rates for the various departments, such as screen making, printing, finishing and shipping. Allocation of your expenses could be based on the investment in a particular job station in relation to the overall investment in you shop.

A more accurate but a much more complex method of cost allocation is to assign shop and administrative costs to individual departments within your shop. Developing a complicated estimating system, such as this, requires more time to construct, implement and maintain. For most sign shops, this is impractical. For larger manufacturers, with distinct departments, each of which having distinct production overhead costs, activity based costing is often necessary.

Having worked for screen printers, the basic departments in manufacturing include: design and production art; screen making; printing; finishing; and shipping. An activity based costing system requires that you divide expenses into two categories. To the primary category you could assign general expenses which apply to your shop as a whole. You could divide these primary expenses to the different departments within manufacturing based on the square footage utilized by that department.

The next step is to identify those costs of which are unique to that department. In a print shop these costs include the expenses associated with the equipment used specifically in a department. In the print department, these include costs for presses and racks. In finishing, the equipment costs that need to be accounted for include plotters, die cutters and laminators.

After adding up the primary and secondary costs for each department for a specific time period, the costs are divided by the number direct hours charged in that department for the same time period.

You can see how complicated that this method for cost allocation is. The advantage is that you assign a more realistic and accurate amount of overhead for a particular activity. More precise allocation of overhead ensures that it is less likely that you will lose money as well as less likely that you will leave money on the table. It also means that you are less likely to overcharge and price yourself out of the market. The risk, though, is that anytime a system becomes more complex, you increase the odds that a mistake can occur.

Tracking Overhead

Your shop overhead will either increase or decrease over time, especially if your business is rapidly growing. As your shop sells more, your variable costs will increase. Utility costs will typically increase, as well as will your expenditures for shop and office supplies and salaries for new personnel.

Discretionary spending on advertising and travel and entertainment often also rises as the good times roll and occasionally can get out of control. The good news these discretionary expenses are the easiest to cut when the need arises. As shop and administrative increase, you need to track your overhead expenditures and how it affects your shop rate.

Here is an actual example of how changes in overhead and direct labor hours affected the hourly shop rate for one screen printer during the first three years of operation:

Year 1 $600,000 Overhead = $50/Hourly Shop Rate 12,000 Direct Labor Hours

Year 2 $800,000 Overhead = $44.45/ Hourly Shop Rate 18,000 Direct Labor Hours

Year 3 $1,020,000 Overhead = $ 35.42/ Hourly Shop Rate 28,800 Direct Labor Hours

Labor Hours

In estimating labor hours for any job, you want to separate it into the various activities or cost pools involved in its production. For a digital printer, these discrete activities might include:

- Design & Production Art

- Sheeting (of vinyl material)

- Printing

- Laminating

- Plotter cutting

- Packaging & Shipping

- The second step in costing the job is to estimate how much time is required for each activity. By totaling the number of hours for the different activities and multiplying the total by the shop rate, you have calculated your labor cost for the job. If you are producing a number of the same graphic, divide the total by the number of units produced.

Sample Estimate

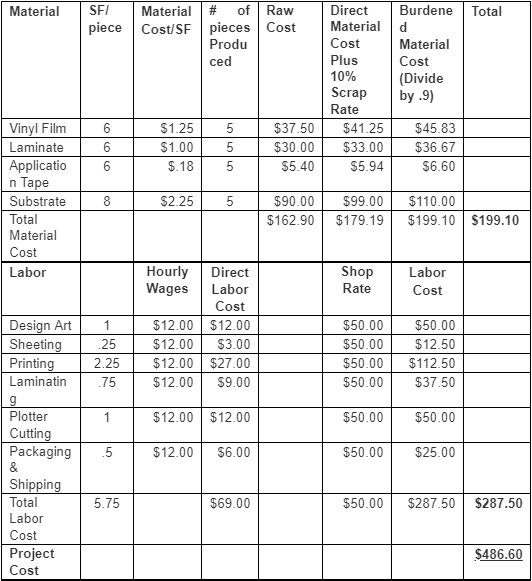

In this sample estimate, the Direct Costs include $179.19 in Direct Material Cost (with an additional 10% scrap rate) and $69.00 in Direct Labor Cost for a total of $248.19.

By comparison, when you allocate shop overhead using labor as the cost driver, the total project cost is $486.60, which includes $199.10 in Burdened Material Cost and $287.50 for labor.

Pricing

Costing and pricing are different. Estimating your costs in producing of a job just covers your expenses for the project. Just as you and your employees deserve a paycheck, your business, as a separate entity, needs to realize a return on investment, regardless of whether you are the sole owner or you have investors.

Costing provides you with the foundation for determining a competitive selling price. After you estimate your costs, you can calculate your selling price – one that provides your business with an acceptable profit and allows you to remain profitable in your market.

Remember, that there is a difference between the estimated cost, which just covers your direct and indirect costs, and your selling price. The easiest way to establish a selling price is to calculate all of your direct costs along with an allocated portion of your overhead and add in a percentage for profit.

Suppose, for example, that you would like your business to add 25% profit to your costs on the job. To do that you divide $486.60 in costs by .75 to achieve a selling price of $648.80.

Job Closeout

As a sign maker you understand better than any outsider, what your direct and indirect costs are. Based on your experience you have the ability to develop costing standards particular to your business. After you complete your jobs, you need to compare your estimates with your actual costs from a selection of key projects in a closeout session with your key employees. From that comparison, you can review the variances and reevaluate your standards.

For an accurate comparison, you must maintain good records on material pulled for a job and production hours charged to specific activities, such as design and production art, machine set up, printing, laminating and plotter cutting.

A careful comparison between the estimate and actuals will reveal any shortcomings in estimating standards or production planning. The closeout process should also uncover any deficiencies in purchasing practices and production problems. Periodically, you should also recalculate how any changes in your overhead costs and production volume affects your hourly shop rate.

Conducting regular job closeout session gives you an opportunity uncover any variances between your estimates and the actual material used and actual recorded labor in production. If major discrepancies are revealed, you need to determine the source of the inaccuracies.

If you are not recording material used, you need to institute some type of tracking system such as using a materials requisition sheet. From your time cards you will also need to compare the actual number of hours charged to a job versus your estimated labor.

If more material or labor was used than projected, you need to determine if there was a problem encountered or was your estimate unrealistic. From your review of the job, you may determine that you need to make changes to your estimating procedures. These changes could include adjusting your scrap rate, or modifying your labor standards. On the other hand, if your estimate was reasonable, the job closeout may reveal problems in manufacturing.

Conclusion

The benefits of developing and implementing a costing system, similar to the one described, ensures that you cover all of your direct and indirect costs. More realistic costing also provides a solid foundation for pricing jobs so you can make more sales at a higher profit in a highly competitive marketplace.

Developing a costing program requires that you to examine your manufacturing practices, track all of your expenses and measure variances between estimated and actual costs. Evaluating your operation not only helps in establishing production standards, but also reveals where you need to make improvements in areas, such as purchasing practices, production planning and shop supervision. That way you can take the necessary corrective actions.

There are several different methods of cost allocation. Per se, there isn’t just one right way to allocate overhead. Each way has its own merits, as well as its own shortcomings. Allocation of overhead is not a precise science – quite the contrary. You can apply each one of these methods to the same set of numbers (the same direct labor and direct material costs and the same overhead) and come up with very different results. As a shop owner, you need to discover which method works best for your business.